In fragile markets, risk is often treated as a constraint—something to be minimised, avoided, or borne reluctantly. But here’s a thought: what if we reframed risk not as a reason to hesitate, but as a reason to invest differently?

For funders navigating volatile environments—where instability, inequality, or weak infrastructure complicate traditional development approaches—mentoring offers a distinct advantage. It’s a low-cost, adaptive, and human-centred approach that strengthens capacity from the inside out. And crucially, it’s one of the few interventions that delivers both immediate and systemic value in uncertain conditions.

The Cost of Conventional Interventions

Large-scale investments in fragile contexts frequently come with high overheads, slow uptake, and heterogeneous results. Without local trust, strong relationships, or adaptable leadership, programmes often falter when conditions shift, as they inevitably do. Mentoring, by contrast, is relationship-first and agile by design. It unlocks local leadership and peer support networks that persist beyond programme timelines. The evidence from mentoring-led programmes in heterogeneous contexts such as Tunisia, Ghana, and Lebanon tells a consistent story: investing in human relationships can reduce fragility, not just work around it.

Mentoring in Action: Lessons from Fragile and Transitional Contexts

Tunisia: Supporting Entrepreneurial Growth Amidst Economic Strain

In partnership with the European Bank for Reconstruction and Development (EBRD) and GIZ, The Human Edge has supported mentoring programmes that delivered measurable business resilience under complex conditions. In Tunisia, where youth unemployment and political uncertainty challenge entrepreneurial growth, mentoring-centred interventions have led to high business survival rates, increased revenues, and tangible leadership development.

The GoRise mentoring programme (GIZ Tunisia, 2022), for instance, supported 21 early-stage tech entrepreneurs through personalised learning journeys combining mentoring, business coaching, and technical training. Despite the economic and political headwinds, the programme created 162 new jobs in just five months. 67% of participants increased revenue, and 28% secured new funding. Just as importantly, 93% reported increased confidence and readiness to expand—foundations for long-term resilience.

Similarly, the Women in Business programme (EBRD Tunisia, 2017–2019) paired 12 women entrepreneurs with trained mentors, resulting in 100% business survival over 12 months, 87 new jobs, and 58% of participants increasing profits. The focus on confidence, leadership, and governance through mentoring proved especially effective in a constrained economic climate.

Ghana: Building Capacity in Early-Stage Climate Innovation

In Ghana, a mentoring-led pilot with the Ghana Climate Innovation Centre (GCIC) showed similar promise. Entrepreneurs reported that mentoring improved not only their strategic clarity but also their personal resilience. Two-thirds of the cohort advanced their business development stage, and 50% reached commercialisation—remarkable outcomes given the challenges of building climate enterprises in an under-resourced ecosystem.

Notably, GCIC staff were also trained to embed mentoring practices internally, ensuring continuity and reducing reliance on external actors. This reflects mentoring’s dual benefit: strengthening individual leaders while embedding institutional capacity.

Lebanon: Anchoring Impact Through Mentoring in a Fragile Financial Ecosystem

In Lebanon, the SANAD Technical Assistance Facility implemented a mentoring programme for women entrepreneurs during a period of economic freefall and systemic uncertainty. What set this programme apart was its emphasis on personalised, trust-based support.

Mentoring offered participants not just technical guidance but a sense of community and emotional resilience—intangible assets with tangible outcomes. Participants maintained business operations, adapted strategies, and reported stronger decision-making confidence. Several have since become peer mentors themselves, signalling mentoring’s ripple effect in rebuilding fragile ecosystems.

Why Funders Should Pay Attention

- Mentoring is low-risk, high-yield. It doesn’t require heavy infrastructure or extensive systems change to start delivering impact. It begins with people—mobilising local knowledge, networks

,and leadership.

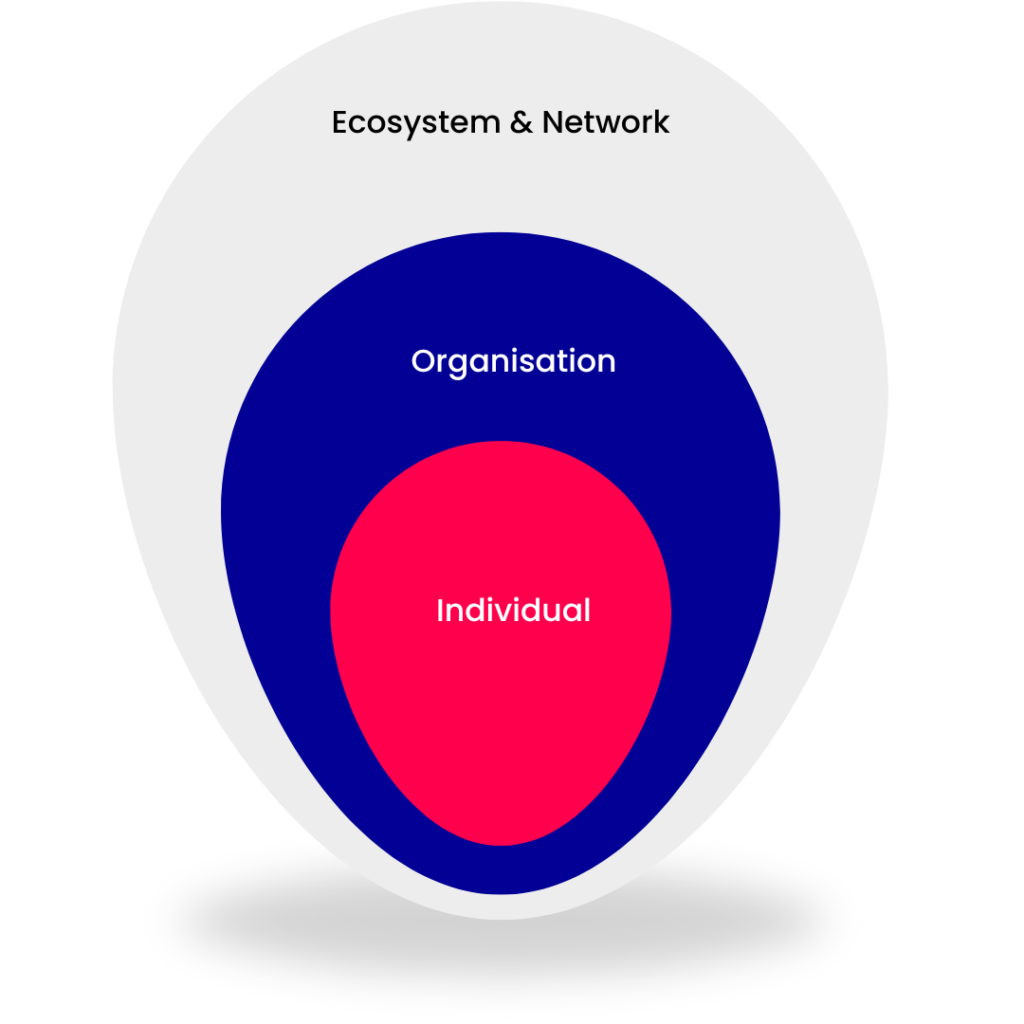

- It strengthens the whole ecosystem. While many interventions focus on technical upskilling or policy reform, mentoring supports the ‘invisible infrastructure’: trust, confidence, decision-making, and resilience.

- It mitigates the human risks that stall programmes. Staff turnover, burnout, disengagement—these are often the Achilles’ heel of development programmes. Mentoring boosts retention, confidence, and long-term commitment among both leaders and participants.

- It’s adaptive by nature. In fragile environments, agility matters. Mentoring relationships can flex with changing needs and contexts, offering real-time problem-solving and emotional anchoring.

A Strategic, Systemic Investment

When we talk about de-risking development, we often mean building financial buffers or project controls. But perhaps the most effective way to de-risk fragile markets is to invest in people—those with the proximity, potential, and drive to lead change from within.

Funders already know that traditional levers alone won’t deliver resilience. What mentoring offers is not a silver bullet—but a strategic multiplier. One that grounds broader interventions in trusted relationships and lived leadership.

If you’re funding entrepreneurship, climate innovation, or leadership in fragile contexts, ask not just what structures need building. Ask who is ready to lead and how you’re investing in their capacity to thrive.

Want to see how mentoring can fit into your portfolio?

Explore our Mentoring Solutions:

- Mentoring Skills & Practice – for mentors who support emerging leaders

- Running Effective Mentoring Programmes – for L&D teams, HR and programme leads

- Bespoke mentoring solutions – co-designed to support your organisational goals and leadership context